accumulated earnings tax irs

The Tax Court held for the IRS on both the compensation and accumulated earnings tax issues. Accumulated Earnings Tax IRC 531 The purpose of the accumulated earnings tax is to prevent a corporation from accumulating its earnings and profits beyond the reasonable.

Accumulated Earnings And Personal Holding Company Taxes C 2008 Cch All Rights Reserved W Peterson Ave Chicago Il Ppt Download

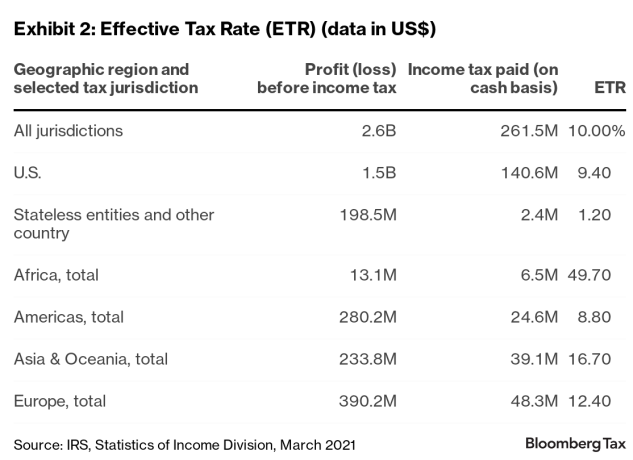

The tax rate on accumulated earnings is 20 the maximum rate at which they would.

. The accumulated earnings tax can be a hidden penalty tax on highly profitable corporations that allow their earnings to accumulate without paying adequate or any. The tax is assessed at the highest individual tax rate. The tax rate on accumulated taxable income currently stands at 20 and fortunately the American Taxpayer Relief Act ATRA kept it from rising to a much higher scheduled rate of.

This requirement is met if more than 20 of the. It required the parties to compute the new tax liability based on the corporations holdings under. The last day of the calendar year in which its tax year begins.

The accumulated earnings tax imposed by section 531 shall apply to every corporation other than those described in subsection b formed or availed of for the purpose of avoiding the income. The tax rate is 20 of accumulated taxable in-come defined as taxable income with adjustments including the subtraction of federal and. The accumulated earnings tax AET was put in place to prevent corporations from doing just that.

The tax is in addition to the regular corporate income tax and is. The accumulated earnings tax is equal to 20 of the accumulated taxable income and is imposed in addition to other taxes required under the Internal Revenue. In addition to other taxes imposed by this chapter there is hereby imposed for each taxable year on the accumulated taxable income as defined in section 535 of each corporation described.

If the IRS finds that a corporation is accumulating income for the purpose of. The AET is a penalty tax imposed on corporations for unreasonably accumulating earnings. The accumulated earnings tax equals 396 percent of accumulated taxable income and is in addition to the regular corporate tax.

The purpose of accumulated earning tax is to discourage the accumulation of profits if the purpose of such accumulation is to enable shareholders to avoid paying taxes on those profits. 1 Accumulated taxable income is. The accumulated earnings tax is imposed on the accumulated taxable income of every corporation formed or availed of for the purpose of avoiding the income tax with respect to its.

The tax rate on accumulated earnings is 20 the maximum rate at which they would be taxed if distributed. Tax Rate and Interest If a corporation accumulates earnings that exceed the exemption amounts an accumulated earnings tax of 20 15 prior to 2013 of the excess. The accumulated earnings tax AET is a penalty tax imposed on corporations for unreasonably accumulating earnings in the corporation.

The accumulated earnings tax is a 20 percent corporate-level penalty tax assessed by the IRS as opposed to a tax paid voluntarily when you file your companys. The regular corporate income tax. Its employee-owners substantially perform the services in 1 above.

Demystifying Irc Section 965 Math The Cpa Journal

Oh How The Tables May Turn C To S Conversion Considerations Stout

Fyi C Corporation Accumulated Earnings Tax

Understanding The Accumulated Earnings Tax Before Switching To A C Corporation In 2019

Redbud Advisors Llc Home Facebook

Demystifying Irc Section 965 Math The Cpa Journal

How Should Llcs Handle Corporate Tax On Retained Earnings

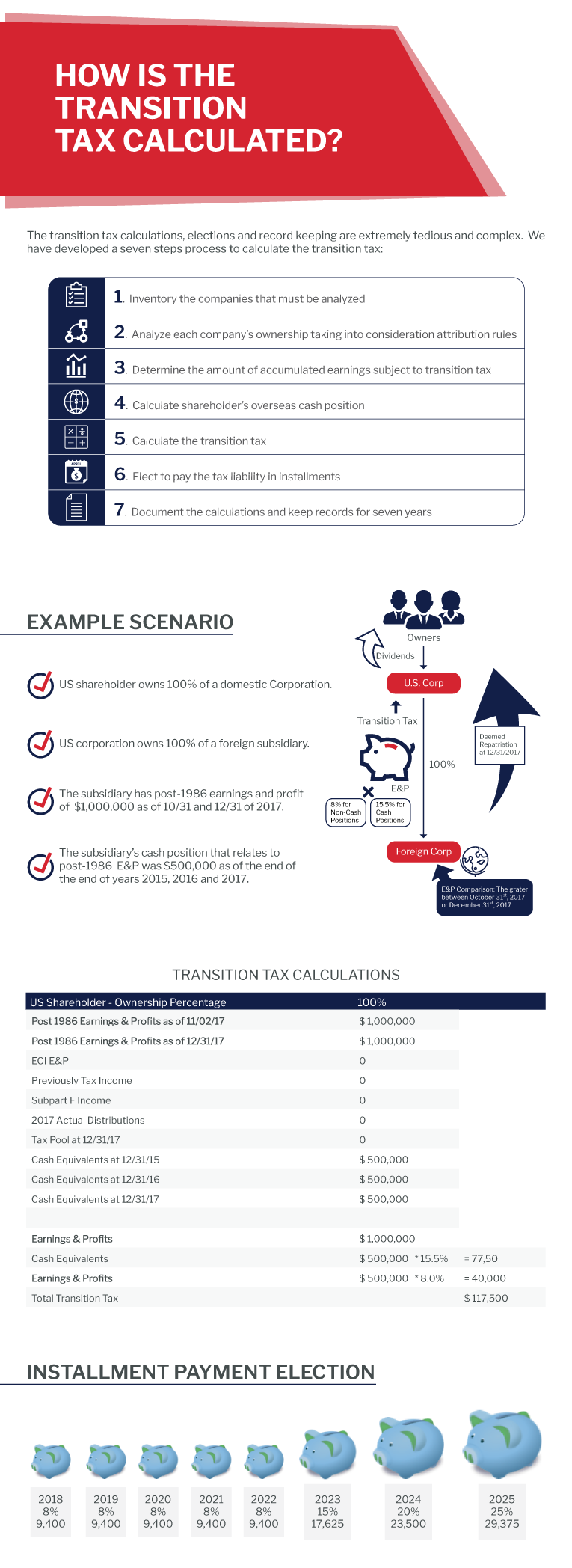

Transition Tax Calculations H Co

Offshore Accumulated Earnings Sf Tax Counsel

Is Corporate Income Double Taxed Tax Policy Center

Simple Strategies For Avoiding Accumulated Earnings Tax Tax Professionals Member Article By Mytaxdog

Accumulated Earnings And Personal Holding Company Taxes C 2008 Cch All Rights Reserved W Peterson Ave Chicago Il Ppt Download

Demystifying Irc Section 965 Math The Cpa Journal

Dormant Foreign Corporations And Form 5471 Rev Proc 92 70 1992 2 C B 435 Htj Tax

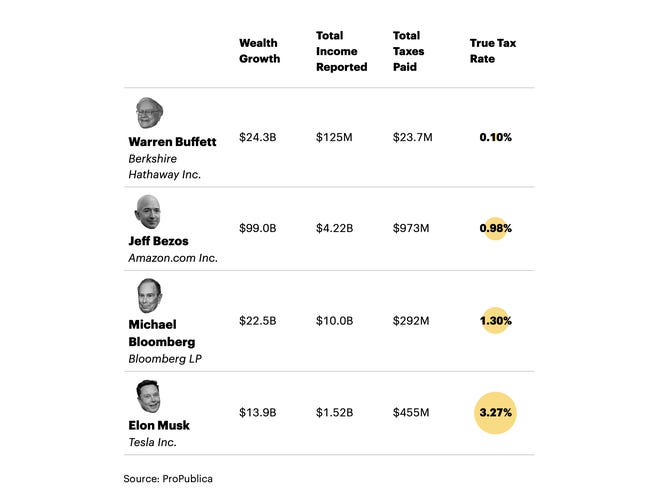

Propublica Tax Leak Story Irs Files Show How Billionaires Pay Low Tax

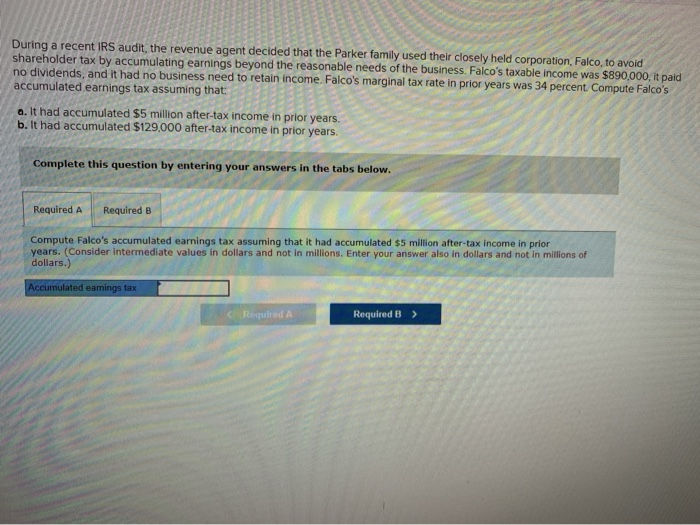

Answered During A Recent Irs Audit The Revenue Bartleby

A Retained Earnings Statement Is Used By Accountants To Also Keep Track Of A Tax Payer S Accounts Sales Report Template Statement Template Report Template

Solved During A Recent Irs Audit The Revenue Agent Decided Chegg Com

How Corporations May Run Afoul Of The Accumulated Earnings Tax A Section 1202 Planning Brief Frost Brown Todd Full Service Law Firm